Analysis establishes a new baseline for sustainable investment: $6.5 trillion in assets identified or marketed as sustainable or ESG investment

For three decades, we at the US SIF, have been in the privileged position of working with the US sustainable investing community to explore the trends shaping the way investors address environmental, social and governance (ESG) issues.

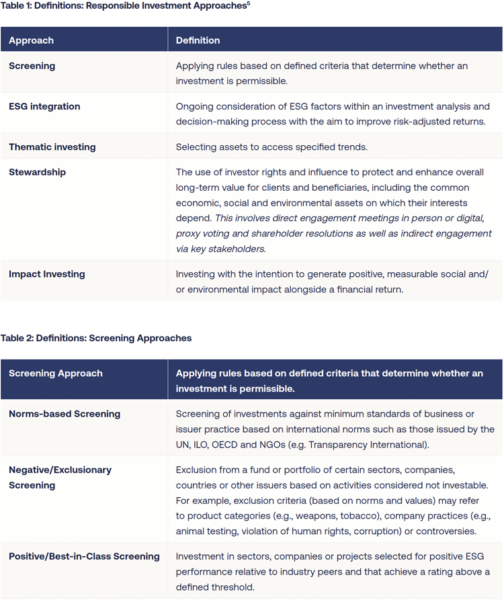

Now on our 15th edition of this survey, we track the evolution of a practice that has moved from a niche approach focusing on values-driven decision-making in its infancy, to a rigorous field centered on financial risks and opportunities directly impacting corporate enterprise value.

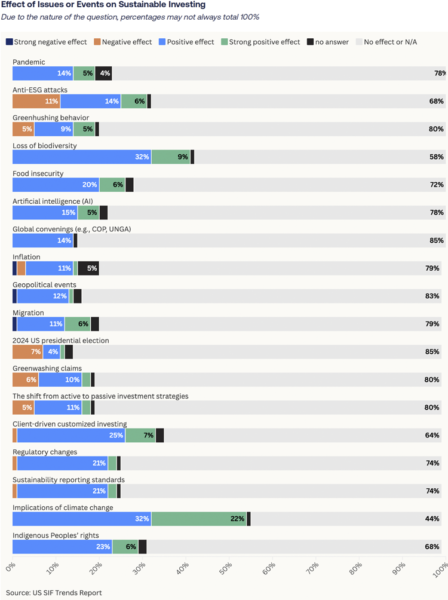

Today, we are on the cusp of yet another evolution. In the two years since we last published, sustainable investing and the financial industry’s approach to ESG has been misrepresented to become the target of political culture wars; anti-ESG legislation has been introduced in multiple states (largely unsuccessfully), and ESG-marketed funds have come under scrutiny for potential greenwashing.

The attention on sustainable investment is a natural outcome for an industry that has grown in both size and influence over the past 30 years. Rather than a roadblock, this is an opportunity to continue to refine the way we address the systemic issues shaping everything from the global economy to our day-to-day lives.

Increased access to data allows investors to value the risks and opportunities associated with ESG issues more precisely than ever before and to demonstrate positive impact. And with the focus on greenwashing, practitioners will need to better articulate how their approach supports long term value creation.

We remain confident in the power of capital markets stakeholders to drive more sustainable, resilient markets for all.

Just as the industry evolves, so does this report. For Trends, the 2024 data represents a new start and a new baseline. We have honed our methodology to address potential double-counting of assets, more clearly identified assets marketed as ‘sustainable’ or ‘ESG’ and have taken a broader view of assets covered under stewardship policies to lay the groundwork to better understand and unpack the policies and practices of investors. This new approach also ensures a replicable process, increases the integrity of the report, improves our understanding of the trajectory of this industry and will allow us to highlight best practice over time.

The sustainable investing of ten years ago will not be the sustainable investing of 2035, but we remain confident in the power of capital markets stakeholders to drive more sustainable, resilient markets for all.

For additional Trends report findings and information visit US SIF.

This article originally appeared on GreenMoney Journal, a strategic partner of Climate & Capital Media.