Fast-track electricity needed for AI — without forcing families and businesses to foot the bill.

The race is on to power the artificial intelligence revolution. AI’s strategic importance to national security and American economic competitiveness is making headlines, but at the same time, companies looking to build out very large data centers are struggling to find enough electric power. Inadequate and outdated market and regulatory processes have led to wait times of nearly five years to get grid access for new generation and lead times of eight years or more to build out new transmission infrastructure.

Big tech companies working to bring data centers online quickly have tried siting these large loads alongside existing power plants, but many of the proposed “co-locations” have sought to co-opt output from these plants. Critics have raised concerns that the deals would worsen customer costs and grid reliability.

A new co-location strategy — which we call “power couples” — can help pioneering AI firms rapidly supply clean electricity to data centers without risking grid reliability.

RMI analysis finds that a new co-location strategy — which we call “power couples” — can help pioneering AI firms rapidly supply clean electricity to data centers without risking grid reliability. Additionally, the approach could improve the affordability of electricity for the average customer while reducing overall grid emissions.

A power couple is the pairing of a large electricity consumer with new-build solar, wind, and battery resources sized to meet the on-site load, all located near an existing generator with an approved interconnection.

This arrangement would trigger a fast-track approval process for connecting the new generation resources to the grid, and strict physical safeguards would ensure that the new load cannot impact grid reliability. Not least of all, costs are borne by the customers creating the demand, who can also take advantage of the modularity of clean energy technologies to reduce their exposure to risk.

Rapidly supplying over 50 GW of new AI load

RMI’s analysis finds that power couples at existing gas generators could rapidly satisfy over 50 gigawatts (GW) of new data center or other concentrated loads with 88% carbon-free energy on average for less than $200 per megawatt-hour (MWh) — and over 30 GW could be satisfied at less than $100/MWh. Moreover, they can do this while reducing system-wide emissions, improving affordability, and maintaining grid reliability.

Load growth challenges

Only a few years ago, load growth was not a concern for the US power sector. From 2014 to 2023, retail sales of electricity rose by less than 3% in total, even as the United States’ population grew by 5% and real GDP jumped 24%. From 2004 to 2013, the story was much the same: Electricity sales edged up by 5% but were outpaced by an 8% gain in population and a 15% advance in real GDP.

Nationwide, utilities are girding for electricity demand to soar by 15.8% over the next five years.

Forecasts for the next decade look dramatically different. Nationwide, utilities are girding for electricity demand to soar by 15.8% over the next five years. Back in 2023, five-year expected growth was only 4.7%.

The increase in expected load growth has been even more dramatic for some utilities. Just last year, Dominion Energy Virginia was expecting its demand to increase by 22% by 2035. But now it expects demand to increase by 58%. Georgia Power was not expecting any load growth through 2035 last year and is now predicting 48% load growth. Duke’s forecast growth rose from 7% to 33%. Data centers are playing an outsized role in this story, with McKinsey & Company predicting that power consumption by data centers will reach 606 terawatt hours (TWh) in 2030, up four-fold from 2023.

Load forecasting by utilities and consultants must be treated with caution, as it has been empirically shown to be well off the mark in many cases. Flexible and forward-looking, the power couples solution can be built at any individual site in phases and scaled up over time to satisfy growing data center and industrial demand without shifting costs onto other customer classes — an especially important safeguard should the new loads not pan out as forecasted. Without the new load, the wind, solar, and storage deployed at existing generators would still be positioned to reduce grid costs and emissions.

How power couples work

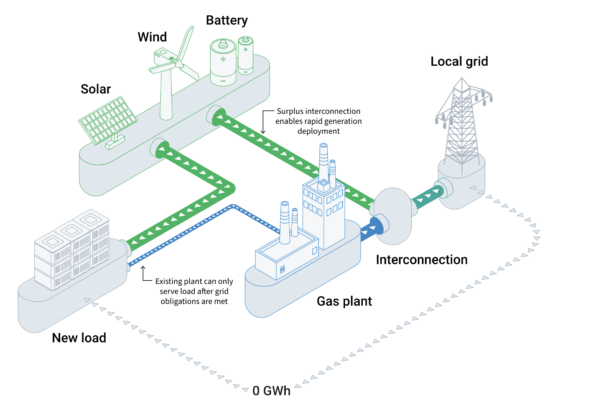

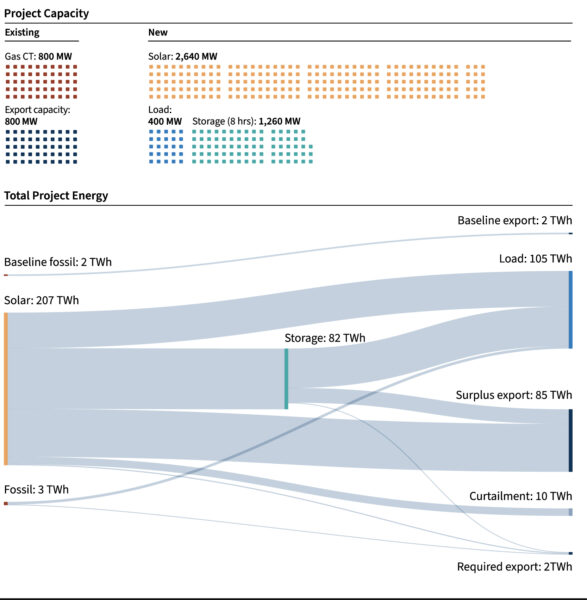

The basic structure of a Power Couple is shown in the graph below. New clean energy resources, such as wind, solar, and battery storage, are built near the site of an existing generator, sending power not required by the co-located load to the grid using its point of interconnection.

The combination is sized to meet the needs of the new large-load customer for all hours while, at a minimum, still satisfying the existing plant’s historical responsibilities to the grid. Physical protections paid for by the large-load customer prevent the latter from using the grid for capacity, energy, or delivery infrastructure.

As a result, the co-located load avoids imposing any additional burdens on the grid. With this approach, costs are assigned precisely to the co-locating parties, protecting other ratepayers from paying for grid upgrades that may not be needed if AI power demands do not fully materialize (or, if they do, from higher locational marginal pricing or reliability impairments that would follow from load drawing from an over-stressed grid).

Power couple co-location at the site of an existing natural gas generator

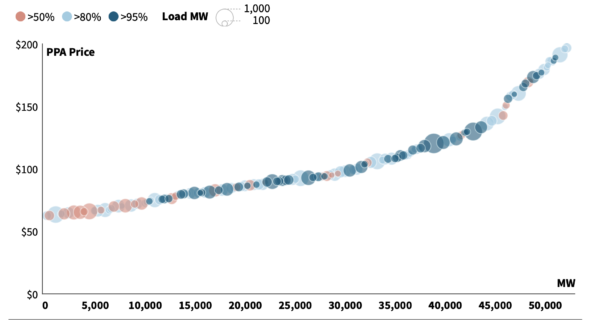

The RMI model identifies over 50 GW of load that can be met below $200/MWh (and most of it far more cheaply, with over 30 GW below $100/MWh), using at least 60% carbon-free resources (again, most of it far cleaner, with an average of 88% clean) built near existing gas generators. Methodological details are in the Appendix.

The graph below depicts the cost curve by opportunity, with carbon profile (percent carbon-free) and size in megawatts also reflected.

Power couples supply curve at gas generator sites

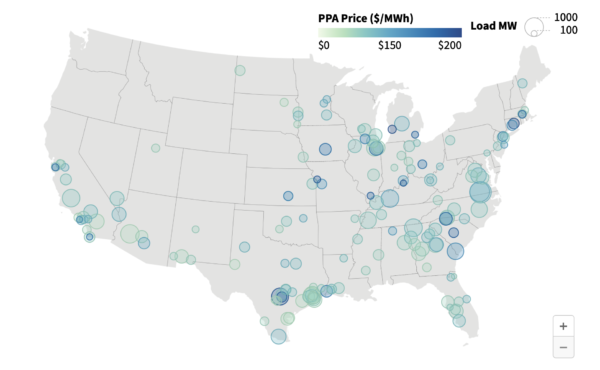

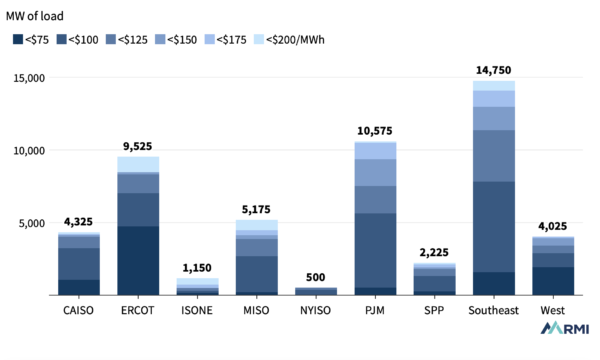

While the potential for power couples is distributed nationwide, the largest opportunities are within PJM (the regional transmission organization for much of the Mid-Atlantic), ERCOT (the organized market for most of Texas), and the Southeast. These regions are also experiencing particularly heavy forecasted load growth from data centers and new manufacturing.

The map below shows the potential of power couples on a map of the United States, and the graphic below it shows aggregated totals for the organized US power markets as well as the vertically integrated regional areas.

Gas generator sites suitable for power couples across the United States

Regional potential for power couples at gas generator sites

Principles for successful and equitable co-locations

Reflecting on our analysis of the co-location potential at existing gas generator sites, RMI has developed a set of guiding principles for other co-location solutions — including siting load with new or planned gas, solar, wind, storage, and/or geothermal. Observing these principles can help co-locations of many stripes reduce emissions and satisfy load growth while maintaining affordability and reliability:

- Just and reasonable: The rest of the grid and its customers should be shielded from any additional costs and risks associated with serving the new large co-located load.

- Reliable: Projects must not endanger — and preferably should improve — local grid reliability for the load’s lifetime. Rigorous physical protections are called for to prevent co-located load from burdening the grid in the event that its associated generation trips. If the co-located load is allowed to make use of grid-supplied energy, any such utilization should be contingent on fulfillment of grid requirements and in exchange for suitable compensation for access to and utilization of those resources.

- Rapid: Fast, efficient interconnection is a valuable resource supportive of national security and global competitiveness.

- Clean: Co-location should support the achievement of both corporate and policy-driven emissions goals. To do this, the new resources should be designed to reduce expected absolute system-wide future emissions (greenhouse gases and other pollutants) relative to a counterfactual without either the new load or the new resources. This would ensure that co-location not only powers new co-located loads cleanly but actually provides emissions benefits more broadly to the local grid.

Co-location of new generation using an existing generator’s grid connection allows resources, including solar, wind, and storage, to interconnect in a fraction of the typical wait time under the “surplus interconnection” provisions established by FERC in 2018 in Order 845.

However, there are no consistent processes or rules in place across markets that expedite the interconnection of load just because it brings sufficient generation to not need grid services. Further, the ability to own or contract significant generation behind the meter varies widely across the nation. In the most welcoming venue, ERCOT, a power couple solution should face few hurdles from the electricity market rules or state laws.

In a power couple, new carbon-free generation avoids transmission upgrade costs and has the option to sell surplus energy back to the grid, offsetting its costs.

Vertically integrated utilities as well as rural electric co-ops and municipal utilities also face fewer regulatory barriers to implementing power couples if they are strategically and politically aligned with the approach. In many other jurisdictions, however, the solution could be stymied simply because running wires between new-build clean generation and co-located load would violate laws governing incumbent utility rights if a public roadway is traversed. Undoubtedly, grid operators and officials in many states will need to be engaged to unlock the full potential of the approach.

Related content:

The battle for gas between data centers and LNG exports

Energy transition: A race between tipping points

But the benefits make concerted action well worth it. In a power couple, new carbon-free generation avoids transmission upgrade costs and has the option to sell surplus energy back to the grid, offsetting its costs. For its part, the utility/grid operator gains access to new generation capacity more quickly and cost-effectively, helping to meet rapidly rising demand.

The following graphic provides an example of project capacity and generation for a potential co-location site over a 30-year operational period.

Illustrative power couple project capacity

(With co-located load, required export to satisfy historical grid obligations and new clean surplus)

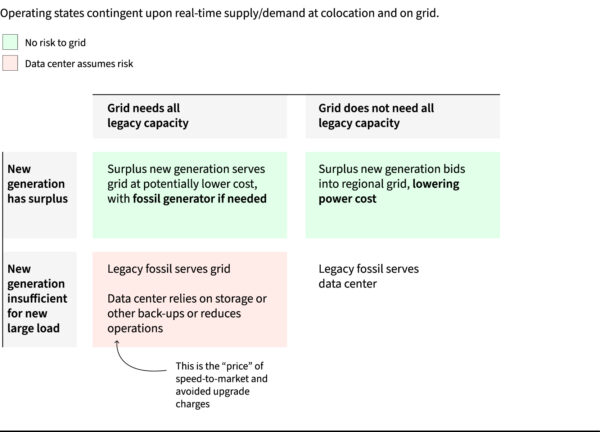

From a reliability perspective, the gas generator’s grid contribution is physically and contractually unchanged. When not needed in its grid-serving role, that generator can provide backup for the co-located load. However, RMI analysis shows that the net emissions on-site would likely fall because these instances would be rare.

The chart below summarizes the obligations and benefits of different modes of operation of the existing fossil asset and the new resources under different grid conditions.

Benefits and obligations matrix

Seizing the moment

Electricity has become critical to economic competitiveness. The United States has been slow off the blocks, with outdated regulatory, siting, and market practices severely hampering the timely deployment of new power infrastructure.

The scale of the investment required and traditional cost allocation methods have stoked concerns about grid affordability and reliability for all customers, while also prompting important discussions around US security and global competitiveness.

The Power Couple concept demonstrates that there are paths forward for meeting this once-in-a-generation opportunity that can support economic, national security, and carbon-free energy goals without breaking the bank for everyday customers.

This article was first published by RMI, which was founded in 1982 as Rocky Mountain Institute. RMI is an independent, nonpartisan, nonprofit that seeks to transform global energy systems through market-driven solutions.

Featured photo: Google data center in The Netherlands. Source: Google