Shareholders in public companies are demanding action, not just wishful thinking and lofty ambition.

As the 2024 proxy season gets underway — and as climate disasters occur with increasing frequency, costing hundreds of billions in damages and business disruptions in recent years — many shareholder resolutions at large public companies focus on the climate crisis.

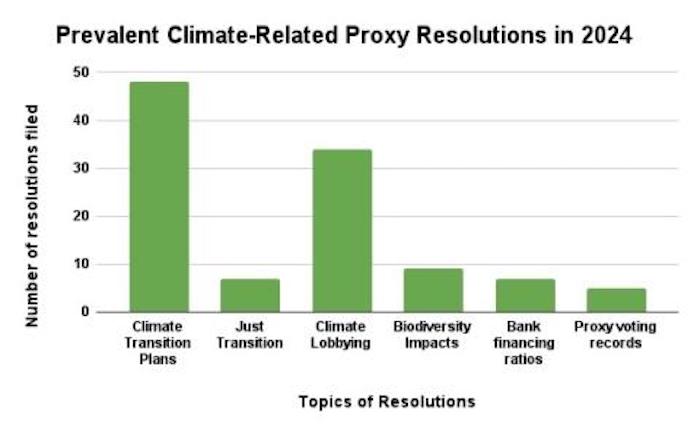

Dozens of this year’s climate-related proxy resolutions say, essentially, “Show us”: shareholders are focused on evidence that companies are following through on their climate commitments. Some resolutions ask for reports on climate transition plans; others ask how companies’ political lobbying activities align with their climate commitments or global climate goals. And a new group of resolutions filed at asset managers that have committed to net zero ask for reports on their proxy voting records and policies.

“Transition planning is the biggest category this year,” among climate-related proposals, said Michael Passoff, CEO of Proxy Impact, speaking in a webinar in March. “Shareholders want to know how companies are adopting the [Science-Based Target initiative] targets and meeting the Paris Agreement goal of 1.5 degrees C.”

Gap between commitments and progress

More than 4,000 companies worldwide have committed to science-based targets for emissions reduction. But corporate emissions reductions are not falling at a commensurate rate, studies show.

“While many companies have established net zero by 2050 goals and interim reduction targets, a gap persists between commitments and actual year-over-year performance on reducing emissions,” nonprofit climate policy group As You Sow found in a recent report.

Source: Barbara Grady/Ceres

Forty-eight resolutions filed for this year’s proxy season call for climate transition plans, according to data from sustainability nonprofit Ceres. At least seven of those ask companies for just transition plans for their workers and communities as the economy transitions.

Forty-eight resolutions filed for this year’s proxy season call for climate transition plans.

From energy and oil companies, including DTE Energy and Chevron Corporation, to industrial equipment manufacturers such as General Electric to agricultural companies such as Archer Daniels Midland and building construction suppliers such as Comfort Systems, shareholders want to know how companies plan to implement climate goals.

Shareholders focus on follow-through

- A resolution filed at Comfort Systems by Boston Trust Walden Company asks that the company create a climate transition plan, noting that although the company’s 10k filing “acknowledges the physical and financial risks associated with climate change …[i]n contrast to many of its peers, Comfort Systems has yet to disclose a comprehensive emissions inventory inclusive of Scopes 1, 2, and 3 emissions.”

The resolution notes that the Company’s Scope 1 and 2 emissions rose approximately 30 percent from 2021 to 2022, yet the company has not set GHG emissions reduction goals nor disclosed initiatives to reduce these emissions.

- At DTE Energy, shareholder As You Sow asks for a climate transition plan inclusive of its downstream emissions from its natural gas utility. “Without an economically feasible climate transition plan, DTE faces significant regulatory and market risk,” the resolution states.

“Now is the point in time that [companies] need a plan to achieve their goals,” said As You Sow President Danielle Fugere in an interview. “Transition plans help investors understand whether a company is likely to meet its goals. It is a marker of success.”

Seeking a just transition

Many shareholders have filed just transition resolutions, which recognize the need to include workers and communities in planning for companies’ transitions to the new economy and adaptation to warming.

- A resolution filed at food company Kroger Co. by Domini Impact Investments notes, “Farmworkers face heightened climate related risks, including heat related illness and death, exhaustion and heat stress, mental health stressors, increased pesticide exposure, as well as other severe human rights violations including forced labor.” It asks how the company plans to protect workers in its agricultural supply chain.

- The International Brotherhood of Teamsters Pension Fund filed resolutions at Republic Services Inc., Ryder Systems Inc. and United Parcel Service asking for how these companies plan to address impacts on workers and communities in the economic transition.

Questioning support for trade associations

At least 34 resolutions focused on climate lobbying. Shareholders seem most concerned about lobbying by powerful trade associations that companies financially support.

- A resolution filed at PACCAR Inc. by Calvert Research & Management and the New York City Comptroller asks for a report on PACCAR’s lobbying on climate policy. “Companies face increasing reputational risks from consumers, investors, and other stakeholders, if they appear to delay or block effective climate policy. Of particular concern is PACCAR’s membership in — and claims of policy alignment with — a trade association that has actively sought to impede proposed clean truck regulations,” the resolution states. The same resolution was on the PACCAR ballot last year and garnered 47.4 percent support.

“It’s clear that investors are continuing to rally behind key climate-related shareholder proposals, reflecting the sustained commitment to informed, responsible investment stewardship practices and driving corporate action.”

Banks and asset management firms

Shareholders at major banks and asset management firms are also demanding that companies walk their climate talk.

- Shareholders at BlackRock, Goldman Sachs, JPMorgan Chase & Co, Northern Trust Corp. and State Street Corp filed resolutions asking for reports on these asset managers’ proxy voting records on climate-related shareholder resolutions, noting in each case that the firm’s recent voting record “seems inconsistent” with its stated commitment to climate-smart investing.

- A resolution filed at State Street Corp, by United Church of Christ Funds, the pension fund for the Congregational Church, asks that “[s]hareowners request that the Board of Directors initiate a review of both SSgA’s 2023 proxy voting record and proxy voting policies related to diversity and climate change, prepared at reasonable cost, omitting proprietary information.” In February, State Street dropped out of Climate Action 100+, the largest investor-led climate initiative in the world with more than 700 institutional investors participating.

Companies start to take action

Faced with shareholder demands, companies are taking action. So far this year, according to Ceres, 56 climate-related resolutions have already resulted in investors and companies reaching agreements, with shareholders withdrawing resolutions in exchange for companies’ agreeing to take actions sought. Among the highlights Ceres identified are agreements reached between the New York City Employees Retirement System and two banks, JPMorgan Chase and Citigroup, for the banks to disclose the ratio of their lending to renewable energy companies compared to their lending to fossil fuel companies.

“It’s clear that investors are continuing to rally behind key climate-related shareholder proposals, reflecting the sustained commitment to informed, responsible investment stewardship practices and driving corporate action in the face of the rapidly intensifying climate change and nature loss,” said Rob Berridge, senior director of shareholder investment at Ceres, in a statement about this year’s proxy season.

This article originally appeared on GreenBiz.com as part of our partnership with GreenBiz Group, a media and events company that accelerates the just transition to a clean economy.